Hello dear subscribers! Today we’ll be talking about AI!

In today’s bulletin, we are covering:

- Surfing the Market, with the AI Index and RWA

- Don’t miss the News about ETFs, and Strategy’s Bitcoin Investments

- Dolomite is under the spotlight.

- A short article about CZ, the Architect Behind Binance

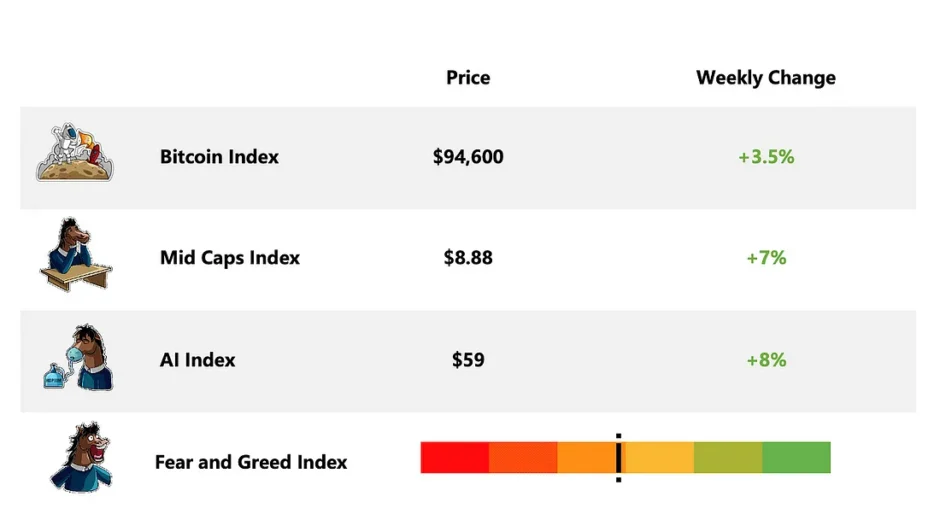

Checking on the AI Index ($NEAR, $RENDER, $TAO, $FET, $ICP and others), we couldn’t ask for a better looking setup. The inverse H&S we spotted weeks ago played on full effect and is now consolidating after breaching up the main downtrend resistance. Really primed setup!

The RWA Index also pushing after a week of consolidation. Breached up the main downtrend resistance and is consolidating the $88 level. Only downside…it still lacks volume:

U.S. Spot Bitcoin ETFs See $1.81B Inflows as Institutional Interest Grows

U.S. spot bitcoin ETFs recorded $1.81 billion in net inflows last week, marking their third straight week of gains, as institutional players like Brown University join the trend.

- $1.81 billion in net inflows into U.S. spot bitcoin ETFs for the week ending May 2.

- Third consecutive week of positive flows, following $3.06 billion the previous week.

- Cumulative net inflows reached $40.24 billion, the highest since Feb. 11.

- IBIT, BlackRock’s ETF, led with $674.91 million in net inflows, totaling $43.48 billion to date.

- Brown University disclosed nearly $5 million in IBIT shares, signaling growing institutional confidence.

- Bitcoin price dipped 1.35% to around $94,606, while ether fell 1.02%.

- Spot ether ETFs also posted $106.75 million in inflows, their second straight week of gains.

Strategy Doubles Down on Bitcoin Bet with $84B Capital Raise Plan

Strategy (MSTR) has doubled its capital-raising plan to $84 billion to accelerate its Bitcoin acquisition strategy, with Wall Street analysts backing the move and praising its first-mover advantage, strong liquidity, and updated BTC performance targets.

- Strategy plans to raise $84 billion via stock and debt issuance, doubling its previous $42B plan.

- Benchmark and TD Cowen analysts maintain Buy ratings, citing strong execution and liquidity.

- BTC Yield target for 2025 raised from 15% to 25%, and expected BTC gain increased from $10B to $15B.

- Strategy has already raised $28.3 billion and has a market cap of $111 billion.

- MSTR trades above its BTC holdings, but analysts view it as “attractive” due to treasury performance.

- CEO Saylor emphasized the “Bitcoin standard” adoption among companies and its market impact.

- CFO acknowledges a $5.9B unrealized Q1 loss but reaffirms long-term confidence.

Dolomite

The Origins:

Dolomite is a decentralized money market and trading protocol designed to offer capital-efficient lending, borrowing, and trading solutions.

It enables users to retain the utility of their assets while using them as collateral, thanks to its Dynamic Collateral system allowing users to stake, vote, and earn rewards while still leveraging their assets for borrowing.

The protocol’s modular architecture supports up to 1,000 unique assets and allows for seamless integrations with other DeFi protocols, unlocking composability across ecosystems. Over time, Dolomite aims to become a hub for DeFi activity, enabling other protocols, yield aggregators, DAOs, market makers, hedge funds, and others to manage their portfolios and execute on-chain strategies.

The Operative:

Dolomite’s architecture is built around two layers: an immutable core layer and a mutable module layer.

This design allows for flexibility and the integration of various features into its core margin protocol.

Key features include:

- Dynamic Collateral System: Users can retain the utility of their assets, such as governance rights, yield-bearing capabilities, and staking rewards, even when these assets are used as collateral.

- Multi-Position Wallet Design: Allows users to open multiple borrow positions from the same wallet, each collateralized by different assets, providing isolated risk management.

- Smart Debt & Smart Collateral: Enables users to optimize asset efficiency by allowing debt and collateral to be utilized as liquidity for swaps between price-correlated assets.

- Automatic E-Mode: Dynamically adjusts loan-to-value (LTV) ratios based on asset correlation, enabling higher leverage when collateral and debt assets move together in price.

- Zap: Streamlines complex flash loans into a single transaction, making it easy to one-click leverage or hedge any position.

- Strategies Hub: Simplifies advanced DeFi strategies such as looping, delta-neutral yield farming, and pair trading, making them accessible to a broader audience.

Summary & Funding:

Dolomite has raised a total of $4.2 million through various funding rounds. Investors include Coinbase Ventures, 6th Man Ventures, NGC Ventures mong others

The $DOLO token is about to enter in circulation and will be launched in Berachain having 1 Billion tokens by Apr 2028.

Dolomite operates in the competitive DeFi space, distinguishing itself through its extensive asset support and innovative features. Other protocols like Aave and Compound offer lending and borrowing services too.

As the DeFi landscape continues to evolve, platforms like Dolomite that offer flexibility, extensive asset support, and innovative financial tools are well-positioned to meet the diverse needs of users. By enabling users to retain the utility of their assets while engaging in lending and borrowing, Dolomite exemplifies the potential of modular DeFi protocols in fostering a more inclusive and efficient financial ecosystem.

CZ, the Architect Behind Binance

CZ is one of the most important names in the history of the crypto ecosystem. His journey, from a humble childhood to becoming the CEO of the world’s largest exchange, is filled with bold decisions, forward-thinking vision, and plenty of controversy. Let’s take a look at his story.

Origins

Changpeng Zhao, AKA CZ, was born in China in 1977 and moved to Canada with his family in the 1980s after the Chinese government cracked down on intellectuals. He grew up in Vancouver and studied Computer Science at McGill University.

He worked for major financial companies like Bloomberg and founded Fusion Systems, where he developed high-frequency trading software. He also worked at McDonald’s (yep, that meme was true). But everything changed in 2013…

Jump into Crypto

He discovered Bitcoin through conversations with people like Bobby Lee and other early pioneers. Shocked and amazed by what he was hearing, he sold his house and invested all his capital into crypto (again, the meme was true).

In 2017, using all his experience building trading systems for traditional markets, he launched what would become the most important exchange in the world: Binance. From day one, the mission was clear:

– Support for multiple cryptos

– Fast and, above all, simple interface

– Low fees

– Strong international presence

In less than a year, Binance became the largest exchange in the world by trading volume.

Problems

Fast growth always attracts attention, and Binance soon caught the eye of regulators. It faced issues in the U.S., the UK, Japan, France, and more. The main accusations were:

– Operating without licenses

– Not complying with KYC regulations

– Weak controls to prevent money laundering

As a result, in 2023, CZ reached an agreement with the U.S. Department of Justice. Binance paid a $4.3 billion fine, and CZ stepped down as CEO. While he wasn’t charged with fraud, he was barred from leading a regulated company in the U.S. for several years.

No doubt, this marked a turning point in the exchange’s leadership.

Future

Although he’s no longer part of Binance’s leadership, CZ remains active in the crypto world through:

– Investments in Web3 startups

– Promoting education

– Working on projects beyond centralized exchanges

He said he’s interested in “building quietly” and no longer being the center of attention or one of the loudest voices in the space (even at the level of Vitalik). Still, his opinions and vision carry weight, and he continues to attend events and conferences, like Token2049 in Dubai, where he’ll be speaking on the main stage this week.

CZ remains an influential figure and is widely considered a living legend in the crypto space. He perfectly represents crypto’s evolution: from the margins of the financial system to becoming part of its core. A true pioneer.

Source: www.medium.com